Why Alimony May Cost You More in 2019

Tax law changes have occurred and will hit people in 2019. Some believe they are beneficial, and others are angry over the sweeping changes that the Administration enacted. No matter how you feel about the new tax laws, they are here and will have an impact. You need to pay attention, particularly if you are considering dissolving your marriage in the near future.

Couples who are facing a divorce will not be affected by the changes to tax law if they finalize their split in 2018. However, those who divorce next year will experience changes in the way alimony is taxed.

Beginning January 1, 2019, alimony payments will no longer be tax deductible for the payer, and the payee will no longer be required to pay income tax on the funds they receive. However, if your divorce is finalized before the end of 2018, the old rules still apply. Therefore, if you expect to have to pay alimony as a condition of your marital settlement agreement, finalizing your divorce this year may prove to be financially beneficial.

How to Expedite Your Divorce in Maryland

Up until 2015, any couple who sought a divorce in Maryland was required to live apart for a full year before they were permitted to file for divorce. Exceptions to that law were made if one party filed for a divorce on the grounds of adultery, desertion, cruelty, insanity, excessively vicious conduct, or certain criminal convictions.

However, even if these one or more of these conditions were present in the marriage, many divorce attorneys still advised their clients to file for a no-fault divorce, out of fear that accusations of adultery or abuse would cause the other spouse to contest the divorce and drag the process out well beyond the 12 months it would have taken to separate in the first place.

If you and your spouse are in a hurry to end your marriage in hopes of avoiding the new tax laws, the good news is that it may still be possible to do so by filing for a no-fault divorce. A new law passed three years ago introduced a new grounds for divorce in Maryland – “Mutual Consent” – which eliminates the one-year waiting period for couples without minor children who are seeking an uncontested divorce. Unfortunately, if you and your spouse do have minor children in common, you must still live separately for 12-months before you can file for a no-fault divorce in Maryland.

Let’s look at three scenarios that show the impact of the new tax laws on divorces:

Bob and Anne have been married for 15 years and do not have any children together. The last three have been less than pleasant, but they have been putting off getting divorced for convenience reasons. Because of the new tax laws, the couple agrees that it’s time to move forward with their divorce.

Under the new Mutual Consent divorce law in Maryland, Bob and Anne are able resolve the terms of their marital separation agreement and forego the 12-month waiting period. Their divorce is currently on-track to be finalized this summer, and Bob will be able to claim a tax deduction for his future alimony payments.

Jim and Natalie are unhappily married, but they have been trying to stay together for their children. Their little ones are just toddlers. Because Jim is the breadwinner in the family, he will most likely be paying alimony and child support when they split. Jim would like to finalize their divorce this year so that he can deduct his alimony payments in the future. Unfortunately, although Natalie has agreed to move forward, they will not be able to finalize their divorce in 2018.

Since there are minor children involved, the couple is not eligible for a Mutual Consent divorce and will be required to complete a 1-year separation. Even if one of them moves out of the family home today, the 12-month waiting period won’t expire until 2019. They have missed out on the opportunity to avoid the new tax laws, and Jim will not be able to deduct his future alimony payments on his taxes.

John and Emily have been married for 7 years and have a 3-year old daughter together. Although they appeared to everyone to be happily married, Emily recently found out that John has been having an affair for over a year. Emily told John that she wants a divorce, and John agreed to move out of their family home immediately. After speaking with her divorce lawyer, Emily is furious to find out that despite John’s infidelity, she will most likely have to make alimony payments to him, since she makes significantly more money than he does and Maryland is a no-fault state.

Emily elects to file for a fault-based absolute divorce on the grounds of adultery, in order to expedite the divorce proceedings and avoid the 12-month separation period. Because John and Emily’s divorce will be finalized in 2018, Emily’s future alimony payments will be tax deductible.

Timeline of a Maryland Divorce

When pursuing a divorce in Maryland, understanding the general timeline of events can help you make appropriate decisions. Of course, just as every marriage is unique, so is every divorce, so it is important to understand that there are many contributing factors that will determine how long it will take your divorce to be finalized. For the purpose of this article, we will focus on the sequence of events relating to a no-fault divorce.

The first step is to seek legal counsel from an experienced divorce attorney to discuss your specific situation and options. While many people facing a divorce will put off meeting with a lawyer in the hopes of saving money, this is usually not a smart move. Decisions made early in the divorce process can have a significant impact on the ultimate outcome, and failure to get proper legal advice early-on can be extremely costly in the long run.

The next order of business is deciding who is going to move out. If you and your spouse have minor children in common, you will need to be separated for 12 months. The clock resets on the 1-year waiting period if the spouse who moves out spends even a single night in the family home.

Next, you and your spouse need to draft a Marital Separation Agreement. This written, legally-binding document tells the court how you plan on dividing property and assets, as well as resolves all issues relating to alimony, child custody and child support. Even if you and your spouse agree on the terms of the agreement, you should seek the advice of an experienced divorce attorney to ensure that this agreement is executed properly and avoid undesirable consequences down the road.

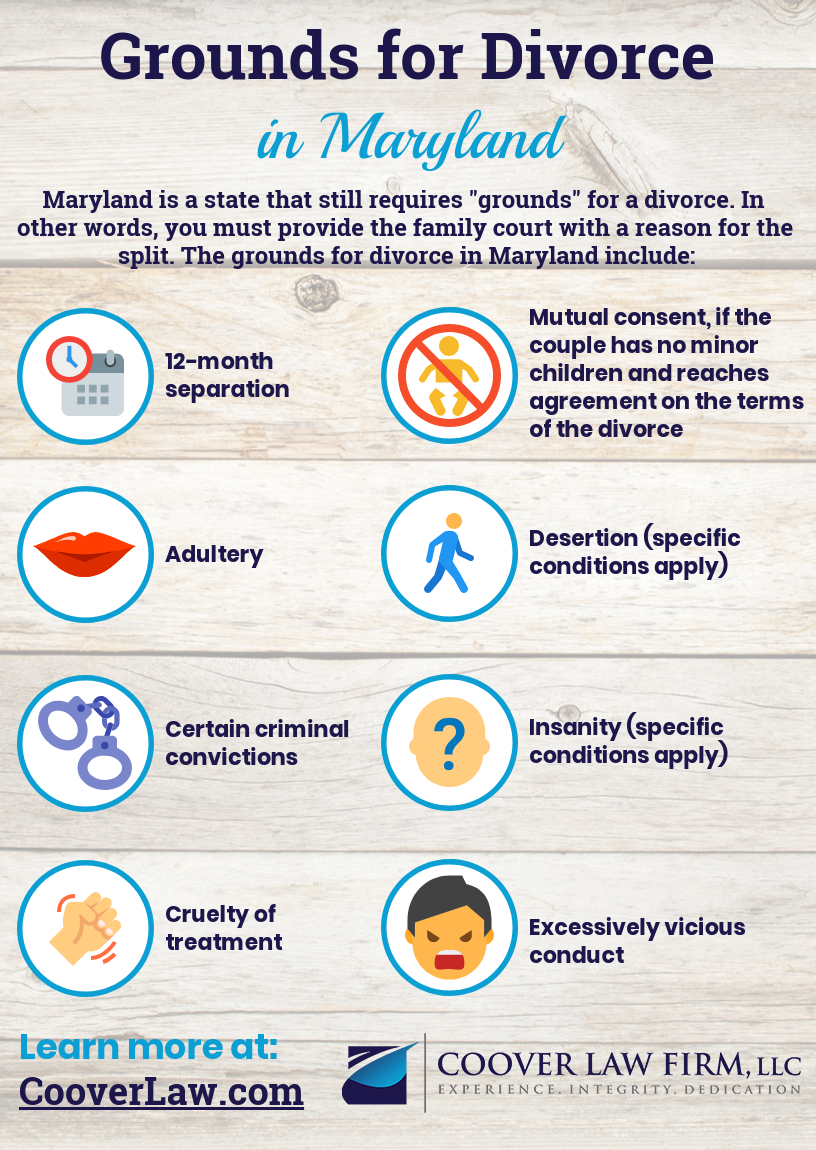

Grounds for Divorce in Maryland

Maryland is a state that still requires “grounds” for a divorce. In other words, you must provide the family court with a reason for the split. The grounds for divorce in Maryland include:

- 12-month separation

- Mutual consent, if the couple has no minor children and reaches agreement on the terms of the divorce

- Adultery

- Desertion (specific conditions apply)

- Certain criminal convictions

- Insanity (specific conditions apply)

- Cruelty of treatment

- Excessively vicious conduct

Even in an uncontested divorce, both parties will need to testify in a court hearing. The plaintiff will need to have a witness to testify on their behalf. If necessary, your lawyer can provide the witness with a subpoena. Once you have appeared before the court, the judge will make a final determination and formalize your “final” divorce.

Speak to a Maryland Divorce Attorney Today

If you and your spouse need assistance with a divorce in Columbia, MD or elsewhere in Howard County, please reach out to our office. We will review your wants and needs, and we will help you make the best decisions for your unique situation. If you hope to be divorced under the old tax laws, you must move quickly. Call our office today at (410) 553-5041 to schedule your appointment.